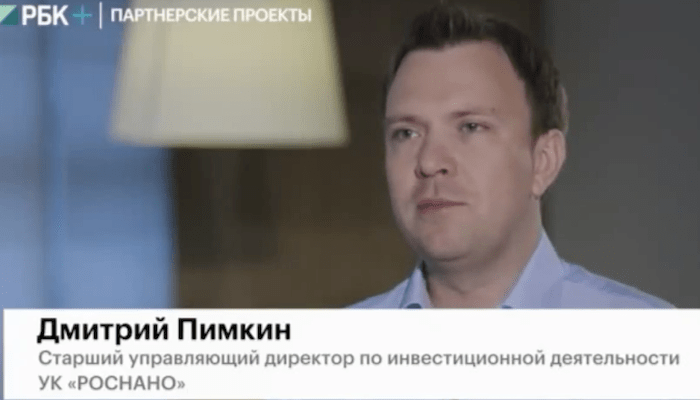

Dmitry Pimkin, Senior Managing Director for investment activities of Management company “Rusnano”, gave an interview to RBC TV channel on:

- investments in a flexible packaging company,

- establishment of a private equity fund, and

- the strategy of forming a group of venture funds.

VIDEO [Russian; Translation support]

Coherent exposition of the interview

1. Scale and Focus of Investment Activity. The speaker outlines the activities of a large institutional investor managing a diversified portfolio that includes dozens of direct investment projects alongside several specialized investment vehicles. These initiatives span both advanced technology segments and traditional real-economy industries. Such portfolio construction reflects a strategic emphasis on industrial development supported by technological enhancement. Direct investments are positioned as a core mechanism for converting technological capabilities into sustainable, market-ready businesses.

2. An Industrial Growth Case with Technological Depth. As an illustrative example, the speaker refers to an investment in a manufacturing enterprise operating in a technologically complex, multilayer product segment. Over a multi-year investment horizon, the company significantly expanded its production capacity. Process sophistication and technological intensity served as key drivers of competitive advantage and operational scalability. Ultimately, the investor exited the project profitably, while the company secured a meaningful share of its market and transitioned into a high-growth phase.

3. Rationale for Partnership-Based Investment Structures. The presentation then addresses the logic behind forming partnership-driven investment platforms built on prior successful collaboration. Experience with jointly developing and launching an industrial facility, followed by a value-accretive exit, validated the “enter–scale–exit” investment model. Building on this track record, the parties opted to formalize continued cooperation through a larger and more systematic structure. The creation of a joint investment vehicle enabled a disciplined approach to further industrial asset development.

4. Capital Structure and External Investor Participation. The new investment vehicle is structured with initial capital commitments shared equally between the core partners. From the outset, the design anticipates subsequent capital expansion through the inclusion of third-party investors. This framework supports scalability while mitigating concentration risk. At the current stage, the investment team is focused on identifying and evaluating suitable projects aligned with the vehicle’s strategic mandate.

5. Strategic Shift Toward a Fund-Based Investment Model. In closing, the speaker emphasizes a strategic transition from direct asset management to investments executed through specialized funds. This model is viewed as more transparent and institutionally attractive for external capital providers. It enables a clear separation between ownership and operational management, simplifies performance measurement, and reinforces a portfolio-based investment approach. Over the long term, the strategy envisions the formation of a diversified group of funds targeting different industries and stages of economic development.

Previous Interview for “Venture News”

Dmitry Pimkin (RUSNANO) gave an interview for “Venture News”.

Which investment funds are currently included in the portfolio of RUSNANO?

“At the present time, RUSNANO has approved the creation of 13 investment funds. They form the financial infrastructure of the nanotechnology market. There are several main types of funds: low-budget project funds, as well as sector-specific and international funds.

Each type of fund addresses its own class of tasks. Overall, through the creation of funds, RUSNANO attracts additional capital from private investors from Russia and abroad into nanotechnology projects, ensures the transfer of advanced international technologies to Russia, and creates additional market mechanisms to support projects at different stages of development.”

In total, RUSNANO has eight investment teams. How many funds are under your management?

“Six funds are currently under the management of my team. One of the newest is a Pre-IPO fund being created with the participation of OAO “Baltic Investment Bank” and several other investors. Its potential size is 1.8 billion rubles, of which 500 million represents the share of RUSNANO. The fund is managed by the company “Baltinvest UK”.

The portfolio of RUSNANO also includes international funds. One of them is the “DFJ-VTB Aurora” fund. It was created jointly with the bank “VTB”. It will be managed by “VTB Capital Asset Management” together with the American firm “Draper Fisher Jurvetson”. The size of the fund is 3.3 billion rubles, half of which is provided by RUSNANO. In addition, RUSNANO is forming a venture fund jointly with the Kazakhstani “Kazyna Capital Management”.”

Can you name the funds that are already making investments?

“At present there are three such funds: “Skolkovo-Nanotech”, “Nanomet”, and “Advanced Nanotechnologies”. The “Skolkovo-Nanotech” fund was created with the participation of the Moscow School of Management “Skolkovo”. Its size is 2 billion rubles, and to date it has invested in one project. Another project is being financed by the sector-specific fund “Nanomet”, which specializes in nanotechnologies in metallurgy. The “Advanced Nanotechnologies” fund has three projects in which funds have already been invested. At this stage, the funds of RUSNANO have allocated approximately 100 million rubles. By the end of the year, the funds “Skolkovo-Nanotech”, “Nanomet”, and “Advanced Nanotechnologies” will invest in three more projects.”

What types of projects do the funds of RUSNANO specialize in?

“Most of our funds do not have a pronounced specialization. We have only two fundamental requirements for projects. First, they must be related to nanotechnologies. Second, production must be located in Russia. We do not impose any special restrictions on industries. Here is a clear example—in the portfolio of the “Skolkovo-Nanotech” fund, two very different projects coexist quite comfortably. One is dedicated to the development of a drug for epilepsy, and the other to the creation of ceramic insulation for power transformers.”

How is project due diligence carried out?

“The review of an application takes place in two stages. At the first stage, experts assess whether the project is related to nanotechnologies. This phase usually takes place with the direct participation of RUSNANO. The second stage is investment due diligence. It is carried out by the management company. After all procedures have been completed, the project is submitted for approval, after which financing begins.”

What difficulties do you encounter when reviewing applications?

“One of the most challenging tasks of due diligence is market analysis. It is necessary to understand the competitive advantages of the new product and determine who will be willing to buy it. It is also necessary to pay close attention to the composition of the project team. It should include not only scientists and authors of original ideas, but also people with business skills. And, of course, the fund’s management team must be ready for active participation in the development of projects, since investment begins at early stages, and this always requires significant effort.”

Do many applicants meet the investment requirements of the funds?

“Very few. That is precisely where the main problem lies. Truly worthwhile and well-prepared projects still have to be found. It gets to the point that our management companies have to compete with each other for the same promising applications.” (07/2011)